Divestment, shareholder advocacy hot topic at GA

The UUA takes an “active shareholder” approach, collaborating with other investors to pressure corporations to make socially responsible choices and avoiding investments in companies that perform poorly on a variety of environmental, social, and governance issues. But not everyone favors this approach. Author Bill McKibben and climate activist organization 350.org have urged educational institutions and religious organizations to divest their portfolios of all fossil fuel companies.

Panelist Cindy Davidson, a board member for the UU Ministry for the Earth, began the afternoon’s discussion by acknowledging the complexity of the issue and the diversity of opinions on the best way forward, but warned that to turn the discussion into a divestment vs. shareholder advocacy face-off would be to miss a valuable opportunity for synergistic collaboration.

Speaking on behalf of the UU Ministry for Earth, she said, “We believe a climate-solution strategy that attacks the fossil fuel industry at multiple pressure points is more likely to succeed in creating the changes we seek. That is, pressure from shareholders, from local, state, and federal legislation and regulation, from consumer demand, and from competing clean-energy sources.” She suggested that, collectively, UUs may have the greatest influence through a variety of collaborative, coordinated efforts and encouraged the audience and congregations to learn more about the issue, pointing to resources on the Ministry for Earth’s website. “Consider carefully which responses are most appropriate to your situation,” she said. “Ask yourself not only whether you should divest or not, but also how you can invest in the future, in energy efficiency, in climate solution, and in your local economy.”

The Rev. Dr. Jim Sherblom, former chair of the UUA’s investment committee and senior minister of First Parish in Brookline, Mass., spoke about balancing investments and values. He discussed his congregation’s endowment fund, the importance of the money being invested according to UU values, and their decision three years ago to move their money to the UU Common Endowment Fund. He said they have been delighted with the results and with the opportunity to pool their resources with those of the rest of the movement to “be able to do some things we could not do alone.”

He also talked about the need for Americans, who have been leaders in world fossil fuel consumption, to make major changes. “I think as Unitarian Universalists, our respect for the interdependent web of all existence of which we are a part calls us to work with everyone who is willing to work with us—whether it’s elected officials, environmentalists, energy company executives, other investor groups, or consumers—to help bring about the change that is so desperately needed.”

The Rev. Glenn Farley, chair of the UUA’s socially responsible investing committee and minister of the UU Fellowship of Sedona, Ariz., addressed why divestment is not the most effective strategy, pointing to data—including a 1997 study in the Journal of Investing—that suggests that divestment has little to no economic effect on the company that’s being divested from. “There are other tactics to choose,” he said, “and that’s what we’ve done at the UUA.”

Farley reiterated information he shared during the morning’s plenary session on behalf of the Socially Responsible Investing Committee, where he said, “Being silent and leaving the table is to abdicate this commitment to the [UUA’s 2006 Statement of Conscience, Threat of Global Warming/Climate Change], it is to abdicate using our gifts to bless the world. The entire Socially Responsible Investing Committee and the Investment Committee view engagement, not dis-engagement, as the most effective strategy for changing corporate behavior.”

Looking forward to the next shareholder season, he said the UUA will continue and increase its climate advocacy and plans to:

- tighten stock selection screens on carbon-intensive industries;

- reinvest profits in solutions by finding investment vehicles that focus on climate-solutions and investing in companies that are building the foundation for alternative energy and a low-carbon economy;

- continue and increase shareholder engagement by pressuring companies to disclose lobbying expenditures and report with metrics on climate change realities and possibilities;

- and make the investor case to policy makers that fossil fuel use is a demand problem, not a supply problem, and requires major changes in public policy.

Tim Brennan, treasurer and chief financial officer of the UUA, talked about what the Association is doing now to apply the principles of socially responsible investing to its portfolio.

The Common Endowment, he explained, uses an investment approach, put together over the course of a decade, which is focused on a high level of diversification to control risk and volatility while delivering steady returns. He said the result has been a 9 percent return per year and when the endowment is compared to like-sized endowments it is in the top 10 percent. “And we’ve achieved this while having a really rigorous, robust socially responsible-investing program.” He said they give one percent to community investments, favor managers with socially responsible investing experience, have filed 37 shareholder advocacy resolutions since 2010, and have been in dialogue with many companies, focusing on LGBT and human rights, political lobbying spending, executive compensation, and climate.

Brennan said, “If you look at the whole portfolio, our exposure to the 200 global companies (that McKibben and 350.org have urged divestment from)—which in the market is about 10 percent—exposure in our portfolio is 3 percent, and that’s because we’re applying all these environmental standards as we look at all the companies.” He said these standards exclude a lot of the big oil and gas companies.

During a Q&A portion that followed, audience members voiced concerns about the lack of urgency being displayed, the effect on those employed in the fossil fuel industry, increases in fossil fuel use in other countries, and whether the UUA is doing enough. Bruce Wiggins, of First Unitarian Society of Milwaukee, Ill., a congregation that has voted to divest from fossil fuels, said he was gathering signatures for an Action of Immediate Witness to start a dialogue on divestment as a tactic, something he saw as complementary to strategies such as shareholder advocacy. “Divestment is a tactic that I think can set some boundaries,” he said, “and the AIW we’re proposing now is to start a dialogue in your congregations.”

Brennan clarified that he is not against churches divesting. “I’m talking specifically about the UU Common Endowment Fund because we have the capacity to have a robust engagement program,” he said. He pointed to the success of the multiplicity of actions used in the anti-apartheid movement and sees this as a similar opportunity. “Let’s get everything pushing in the same direction.”

The Rev. Drew Kennedy, minister of First Unitarian Society of Milwaukee, Ill., said he supports divestment because he doesn’t see enough momentum in the government and feels we need “a galvanizing movement.” In his response, Brennan quoted anti-apartheid leader Randall Robinson, saying that “If you want politicians to lead, form a parade and they will find their way to the front.” He said the great thing about the work of 350.org is that it is “getting the parade started” and said we need to take it the next step and “all get in the parade.”

Sherblom concluded the panel by saying that he believes we will come up with a solution to this problem and that UUs can have a big impact if they find a way to work together. “There’s always room for hope, even in the face of the despair of how much damage we have done as Americans.”

The Summer 2013 issue of UU World featured a two-part forum by Fred Small, minister of First Parish in Cambridge, Mass., and Tim Brennan arguing for and against divestment.

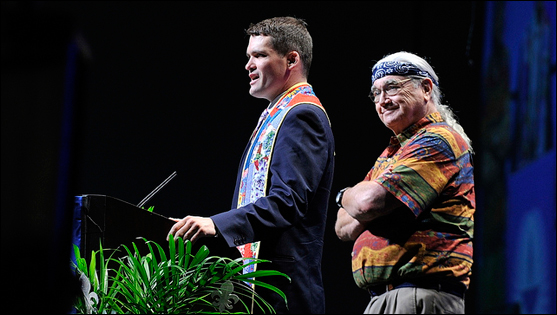

Photo (above): The Rev. Glenn Farley and the Rev. Clyde Grubbs spoke about the UUA’s socially responsible investing work. (© 2013 Nancy Pierce).